AI-Public Company Financial Analysis

Deeply integrates big data, knowledge graphs, and multimodal machine learning technologies to build an intelligent regulatory analysis platform covering financial anomaly detection, holistic entity profiling, and correlated risk penetration. It provides precise, forward-looking risk insights and decision support for regulators and investment institutions.

Request a DemoSolution Value

Core Modules

Intelligent Financial Anomaly Detection & Early Warning Engine

Public Company Holistic Profile & Knowledge Graph Platform

Correlated Risk Analysis & Trading Behavior Monitoring

Bond Credit & Default Warning Extension Module

Overall Architecture

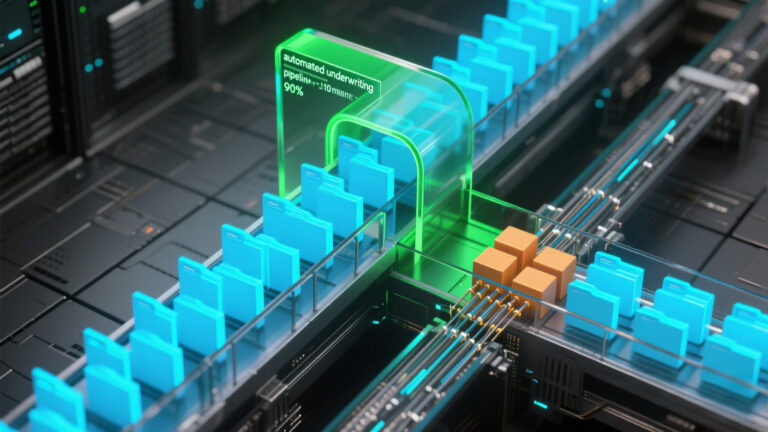

Data Resource & Fusion Layer

AI Algorithm & Model Platform

Intelligent Application & Visualization Layer

Key Advantages

Comprehensive & Multi-dimensional Analysis

Early Warning Timeliness

Deep Correlation & Penetration

Strong Technology Fusion

Regulatory Practical Experience

Quantified Benefits

-

Enhances Regulatory Efficiency: Automates preliminary screening of massive announcements and financial data, allowing analysts to focus on deep investigation of high-risk leads, improving efficiency by multiples.

-

Improves Detection Accuracy: Significantly increases the identification accuracy of complex financial fraud and disguised related-party transactions through multi-dimensional, correlated analysis.

-

Strengthens Risk Prevention: Achieves warnings for risks like bond defaults months in advance, providing valuable time windows for risk mitigation and reducing market impact.

-

Promotes Scientific Decision-Making: Provides quantitative data and model support for evaluating regulatory policy effectiveness, assessing industry-wide risks, and aiding investor asset allocation.

Application Scenarios

-

Intelligent Screening of Public Company Financial Fraud: Deployed a system for a securities regulator. By applying machine learning to historical financial reports and public information, successfully built multiple financial anomaly identification models, generating batch lists of high-risk companies and specific anomaly clues, which became crucial directional references for on-site inspections.

-

Holistic Due Diligence for Pre-IPO/Listed Companies: Served investment institutions and investment banking departments of securities firms. Used knowledge graphs to quickly clarify corporate association networks, verify the fairness of related-party transactions, and assess actual controller risks, enhancing the depth and efficiency of due diligence.

-

Dynamic Credit Risk Monitoring for Bond Investments: Provided dynamic issuer risk tracking services for fund management companies and bank wealth management subsidiaries. Enabled continuous big-data monitoring of issuers’ operations, public sentiment, and judicial status, with warnings for risk contagion within associated groups, assisting credit bond investment decisions and risk control.

-

Market Trading Surveillance & Behavior Analysis: Assisted exchanges and regulatory technology departments. Developed abnormal trading behavior identification models based on trading data and account association graphs, used for monitoring violations like market manipulation and insider trading, helping to purify the market environment.