AI‑Powered Modern Financial Supervision

Leveraging artificial intelligence and multi‑source big‑data technologies, we build a financial‑risk intelligent monitoring and early‑warning platform that covers entire industries, all regions, and full processes—enabling a fundamental shift in supervision from passive response to proactive discovery, and from post‑incident handling to pre‑emptive prevention.

Request a DemoSolution Value

Core Modules

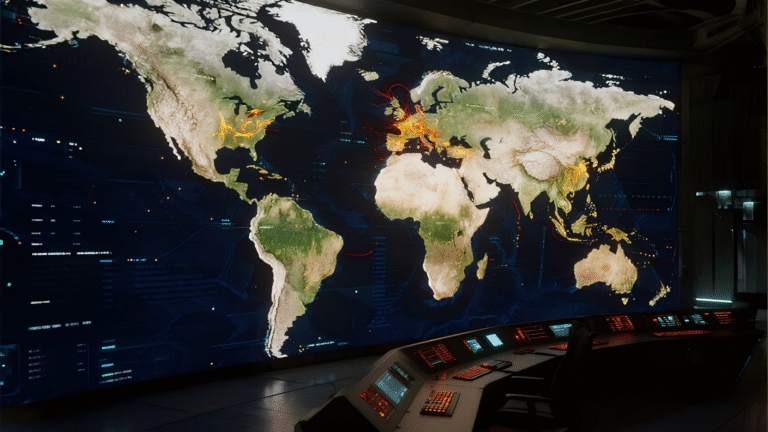

Global Risk Monitoring & Early Warning Dashboard

Intelligent Risk Modeling & Early Warning Engine

In‑Depth Correlation Graph Analysis & Investigation

Dynamic Monitoring & Disposition Tracking Platform

Regulatory Database & Rule‑Base Management

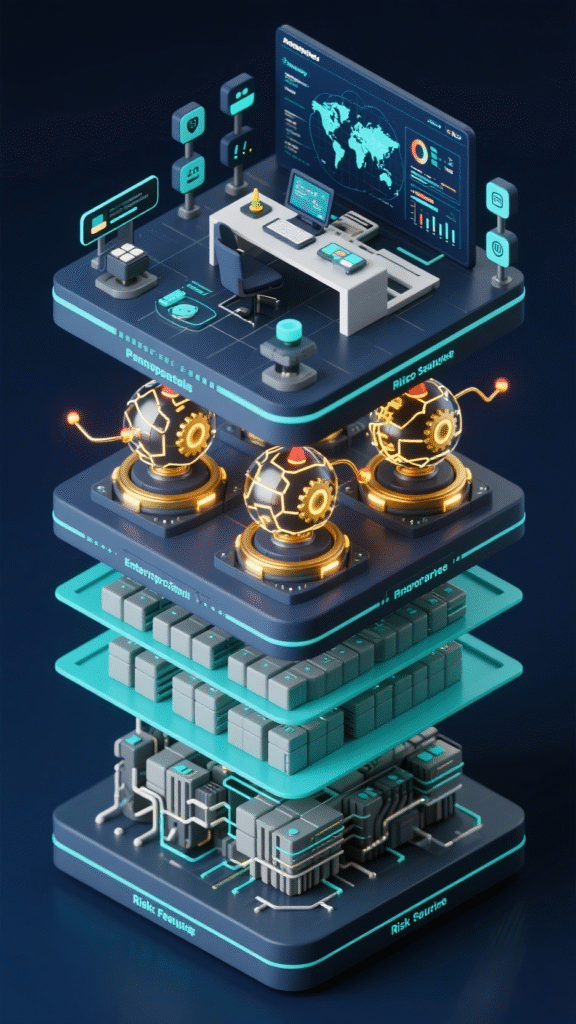

Overall Architecture

Data Fusion Layer

Computing & Algorithm Layer

Intelligent Application Middle Platform

Visualization Application Layer

Security & Compliance System

Key Advantages

Comprehensive Coverage

High‑Precision Alerts

Penetrative Analysis

Real‑Time Response

Flexible Service Models

Quantified Benefits

-

Efficiency Boost

Risk‑screening efficiency is tens of times faster than manual methods, shifting from “blanket inspections” to “precision targeting.” -

Early Risk Detection

Enables early warnings for potential high‑risk enterprises months in advance, providing a critical time window for risk mitigation and resolution. -

Refined Management

Digitizes the entire process of risk monitoring, investigation, and handling—making it traceable and analyzable—elevating the scientific rigor of regulatory decision‑making. -

Cost Optimization

Intelligent automation replaces large volumes of repetitive manual inspections, significantly reducing the labor and time costs of supervision.

Application Scenarios

-

Regional Financial Risk “Radar” Monitoring

Built a “Big Data Financial Risk Early Warning System” for a municipal Financial Regulatory Bureau, enabling intelligent screening of all enterprises in the city. It accurately identifies high‑risk firms for focused monitoring and provides in‑depth risk profile reports, significantly improving the precision and efficiency of combating illegal fundraising. -

Comprehensive Supervision of New Financial Sectors

Developed a “New Financial Sectors Monitoring and Analysis Platform” for a municipal Financial Regulatory Bureau, achieving detailed monitoring and holistic inquiry across 11 sectors such as online lending and private equity funds. The platform serves as critical regulatory infrastructure. -

Provincial End‑to‑End Regulatory Closed Loop

Assisted a provincial Local Financial Supervision and Administration Bureau in constructing a “New Finance Big Data Integrated Supervision Platform.” It integrates 8 major application subsystems including monitoring and early warning, case reporting, and coordinated handling—forming a fully digitalized, closed‑loop regulatory process covering risk discovery, assessment, response, and feedback. -

Cloud‑Based Monitoring & Early Warning Platform

Supported the development of a provincial “Financial Cloud” platform, delivering core regulatory functions such as illegal fundraising monitoring and local financial institution准入 screening via a cloud‑service model. This enhances the modernization of provincial financial risk management and service delivery.