Insurance Products

Building a Dynamic Safeguard That Breathes

We empower leading insurers with intelligent underwriting and precision pricing, leveraging our “Dezhi” LLM and Dynamic Ontology to integrate vast health data and medical resources, creating a unified Insurance-Health-Medical ecosystem.

Learn MoreTransform Insurance Operations

Insurance faces deep transformation, with demands for personalization, dynamic risk assessment, and rising operational pressures.

FundeAI delivers full-stack, actionable technology built on AI, Data, and Security, transforming insurers from post-event compensators into lifetime protection partners.

Smart Solutions:

Identify high-value clients to optimize resource allocation.

Enhance repurchase rates and customer loyalty with data-driven models.

Automate underwriting and claims to cut operational costs.

Build standardized tech capabilities to unlock new revenue streams.

From Empowerment to Symbiosis

01

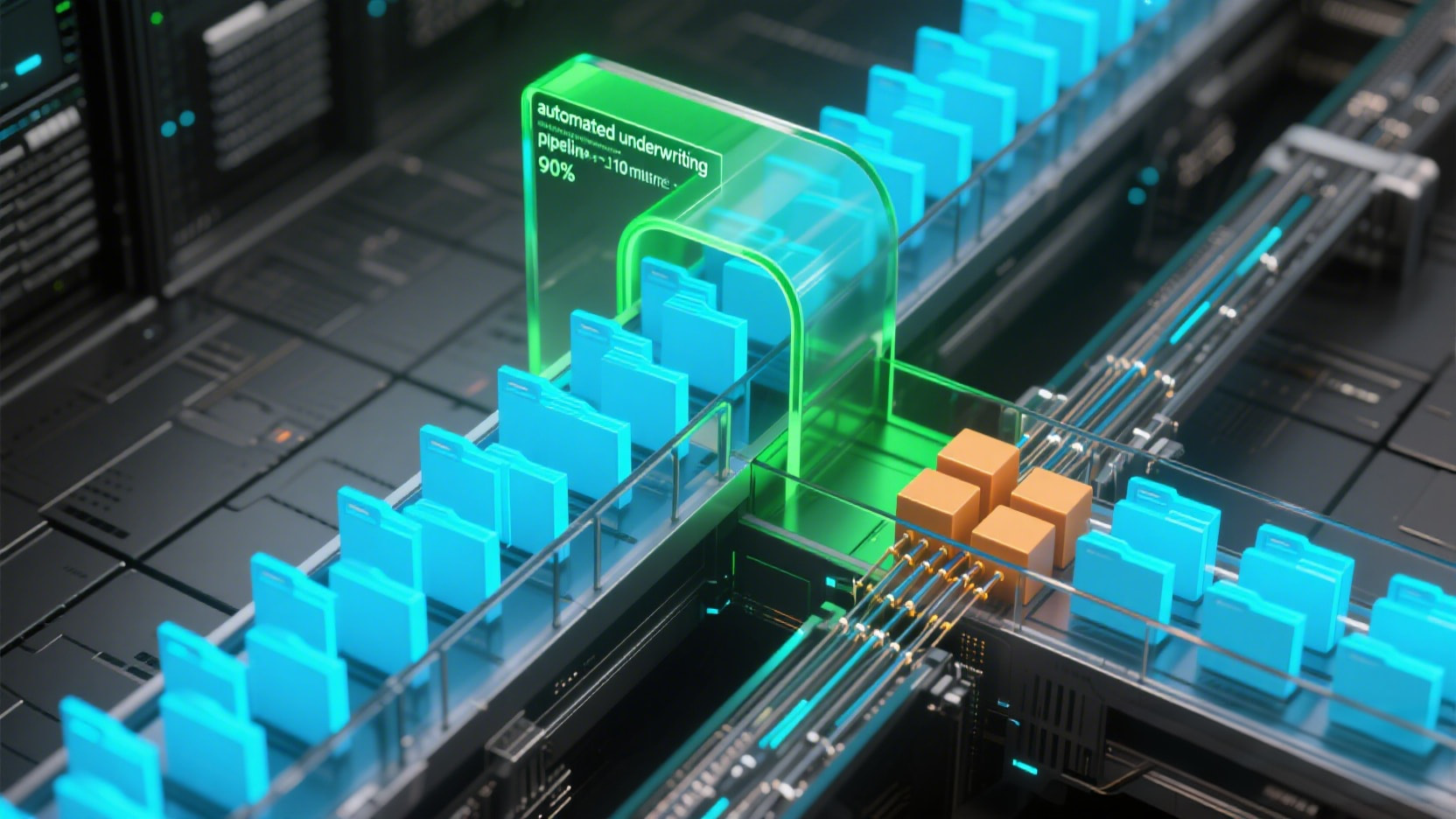

80–92% of standard policies are now auto-underwritten, reducing processing time from hours to under 10 minutes.

02

The AI-powered claims system achieves minute-level settlement, boosting overall claims processing efficiency by 70–85%.

03

Fraud detection accuracy has risen to 92%, leading to an annual reduction in payout losses of 5–8‰.

04

The dynamic incentive system has increased user activity by 40–70% and improved long-term retention rates by 25–38%.

05

Automated customer service has reduced manual workload by 40% and enabled faster client response.

Insurance Ecosystem-Level AI Platform

AI Underwriting System

Powered by a multi-agent architecture, it automates the entire underwriting chain—from customer engagement and needs insight to risk scoring and product recommendation.

- Voice Agent conducts proactive customer interviews.

- Multi-dimensional Risk Scoring with real-time assessment.

- Dynamic Product Recommendations and personalized plan generation.

- Flexible integration with existing business systems.

AI Claims System

Integrates medical knowledge bases, liability rules, and fraud detection models to enable minute-level case review and settlement, with automated liability assessment and payout calculation.

- One-click reporting with intelligent guidance

- Model-driven fraud detection and anomaly alerts

- Reduces payout uncertainty and manual review costs

Intelligent Risk Control & Fraud Detection

Leverages abnormal behavior models, relationship graphs, and trend analysis to build a continuously evolving risk identification system.

- Behavior-level anomaly detection

- Fraud ring identification

- End-to-end policy management

- Real-time risk tiering & tracking

Customized Insurance Product Services

Leverages customer profiles, contextual needs, and data insights to co-create differentiated insurance products with partner institutions.

- Customer segmentation & precise needs insight

- Feature-level customization & scenario matching

- Actuarial assumption & product structure design support

- Joint development of exclusive insurance solutions

Highly Available Foundation & Rapid Implementation

Modular Architecture

Adopts a modular, microservices and multi-agent-based design. Enables independent deployment and flexible scaling of core functions (underwriting, claims, risk control) through decoupled data and logic. Supports rapid iteration of business units and ensures full-process traceability and auditability via unified APIs, providing a highly available foundation for insurance digitalization.

Rapid Implementation

Offers out-of-the-box core modules deployable within 2–4 weeks. Features standardized APIs for quick integration with existing core systems, CRM, and health data platforms. Built-in knowledge and model libraries provide ready-to-use risk control and claims capabilities. An automated toolchain manages the entire model lifecycle (training, validation, deployment), significantly improving rollout efficiency.

Evolvable Data Foundation

A unified data platform ingests and processes multi-source structured/unstructured data. Supports dynamic updates to models and business rules, adapting to policy and market changes. Ensures stability under high concurrency via parallel real-time/batch processing, creating a future-ready digital base that sustainably supports innovative products and scenarios.

Cost Optimization & Technical Value

The integrated architecture reduces cross-system redundancy, cutting O&M costs by 20–35%. Automated underwriting and claims save labor and improve accuracy. Module reuse and standardized APIs further control iteration costs. Supports flexible on-premises or cloud deployment, helping businesses achieve the optimal balance of cost and performance.