Economic Crime Investigation

Challenges

Public security authorities are facing new challenges in combating economic crimes:

— Increasingly Concealed Fraud Tactics:

Fraud schemes have become more covert, with suspects operating across both online and offline channels, forming complex criminal networks.

— Extended Case Timelines:

Cases often span multiple years—from company establishment to the execution of fraudulent activities—making it difficult to construct complete and coherent chains of evidence.

— High Data Complexity:

Effective investigations require the integration of multi-source data, including business registration information, shareholding structures, and social network data.

— Low Efficiency of Traditional Investigative Methods:

Manual analysis is inefficient and struggles to uncover deep and hidden relationship patterns within complex crime networks.

Key Challenges

— How can shell companies and their relationships with ultimate beneficial owners be identified quickly?

— How can criminal networks spanning regions and time periods be uncovered?

— How can investigative knowledge be systematically captured, accumulated, and reused?

Solution

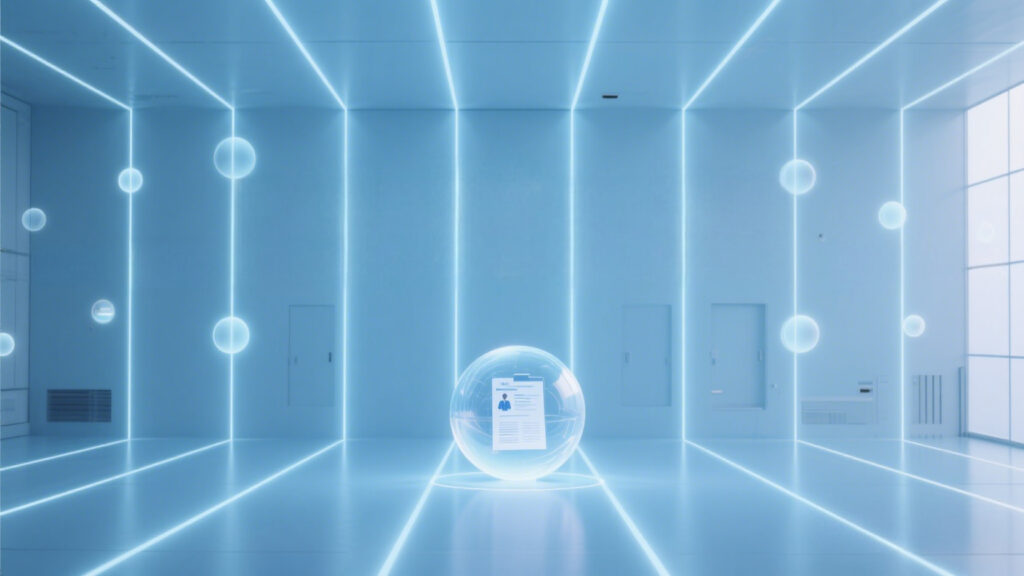

Data Fusion Phase

Multi-source heterogeneous data—including business registration records, banking transaction data, and social network information—are integrated to construct comprehensive relationship graphs of involved individuals and entities.

Pattern Recognition Phase

Machine learning algorithms are applied to identify suspicious patterns, such as shell company characteristics and abnormal fund flows, while risk scoring models are established to quantify investigative priorities.

Knowledge Accumulation Phase

Successful investigative cases are transformed into reusable analytical templates, enabling rapid initiation and analysis of similar cases and supporting the systematic reuse of investigative knowledge.