Commercial Banks

Challenges

A large commercial bank is facing increasingly complex challenges in transaction risk monitoring. The bank processes millions of transactions daily, involving significant transaction volumes. However, its traditional monitoring systems exhibit clear limitations:

— Fragmented Data Landscape:

Transaction data is distributed across multiple independent systems, including core banking platforms, credit card systems, and third-party payment interfaces, making it difficult to form a unified view.

— Manual Analysis of High-Value Transactions:

Large-value transactions and suspicious fund flows rely heavily on manual review, resulting in low efficiency and a high risk of missing critical clues.

— Limited Detection of Hidden Risk Patterns:

Covert risk patterns—such as transaction lineage, one-to-many account control, and other concealed relationships—are difficult to effectively identify using rule-based engines.

— High Real-Time Requirements:

The need for real-time monitoring is critical, yet response delays in existing systems lead to lagging risk alerts.

Key Questions

— How can abnormal patterns in high-value transactions be identified quickly?

— How can hidden lineage relationships and fund flow paths be uncovered?

— How can real-time risk monitoring and early warning be achieved?

Solution

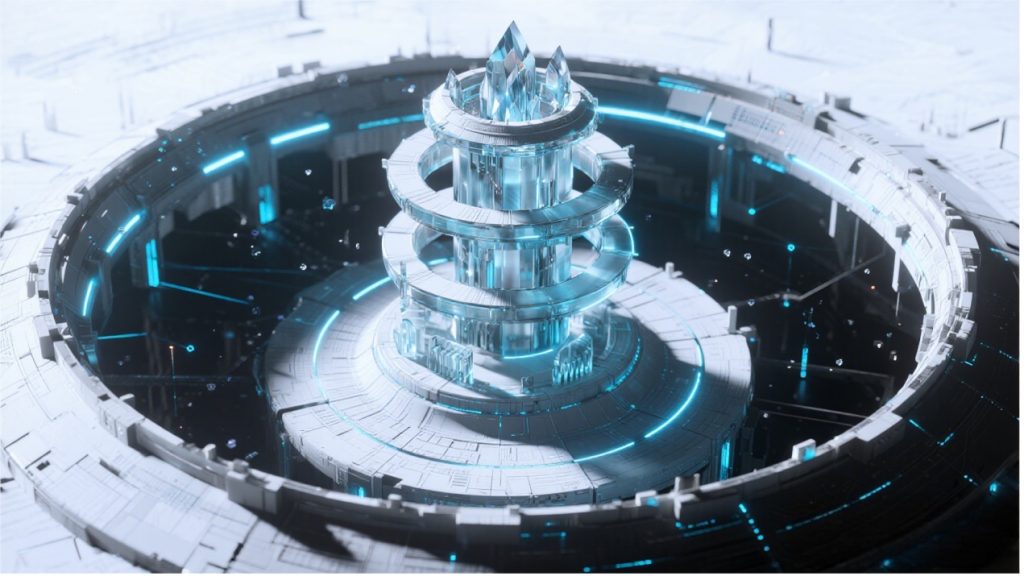

Phase 1: Data Integration and Ontology Construction

The KUNLUN platform first integrates the bank’s transaction data and constructs an account-centric ontology graph. Using dynamic ontology techniques, entities such as account holders, transaction events, and geographic locations are semantically linked, establishing a unified data asset foundation.

Phase 2: Intelligent Exploration and Analysis

The platform provides a visual analytics interface that supports advanced search and intelligent expansion. Risk management professionals can quickly filter transactions exceeding RMB 50,000 through drag-and-drop interactions, while graph-based layouts intuitively reveal transaction relationship networks.

Phase 3: Pattern Recognition and Risk Early Warning

Through timeline animations and group management features, the system automatically identifies transaction lineage patterns and detects abnormal fund flows. In addition, the platform establishes a metrics computation framework to monitor key indicators—such as account in-degree and out-degree—in real time.