AI-Powered Due Diligence

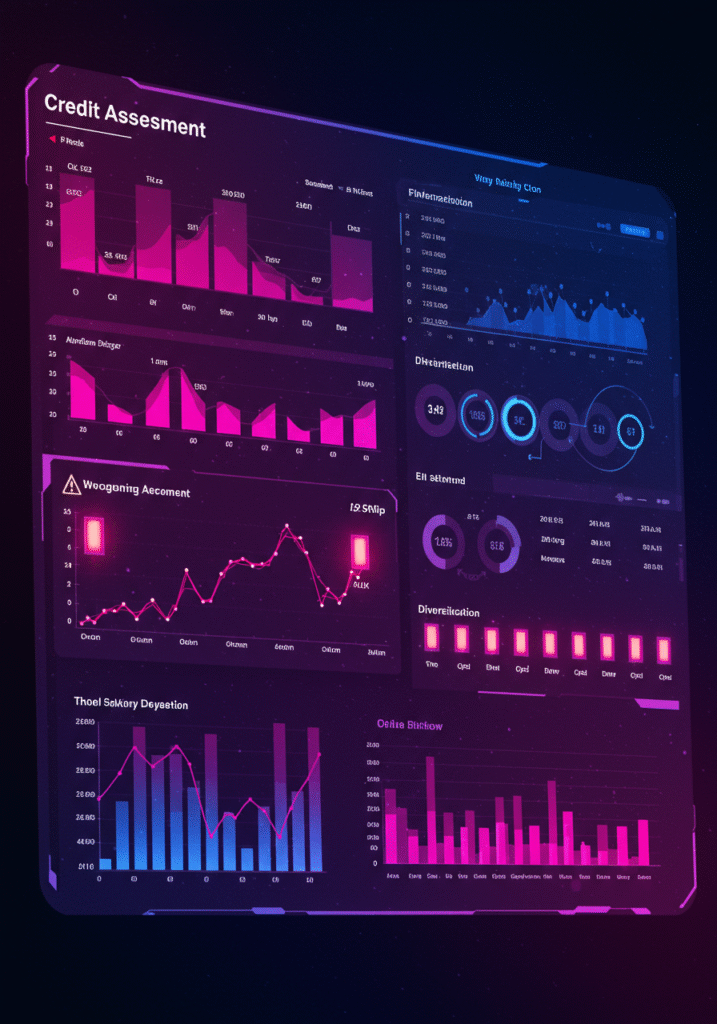

An enterprise data intelligence platform powered by advanced AI models. Through natural language interaction, it instantly generates holistic enterprise profiles and credit reports—delivering precise, efficient data insights and decision support for investment, credit, partnership, and regulatory needs.

Request a DemoSolution Value

Core Modules

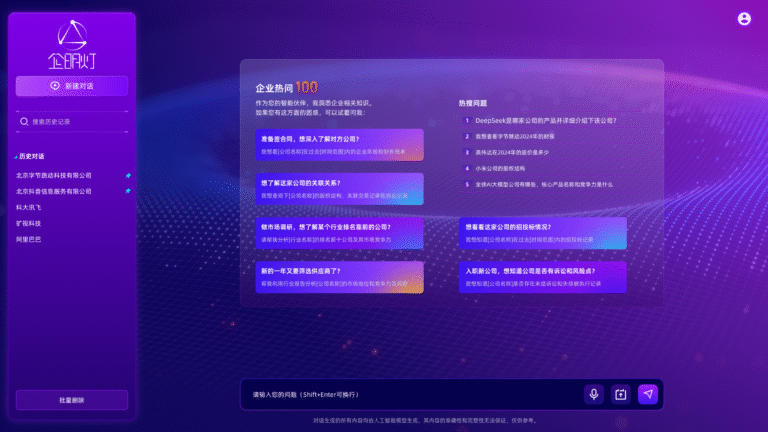

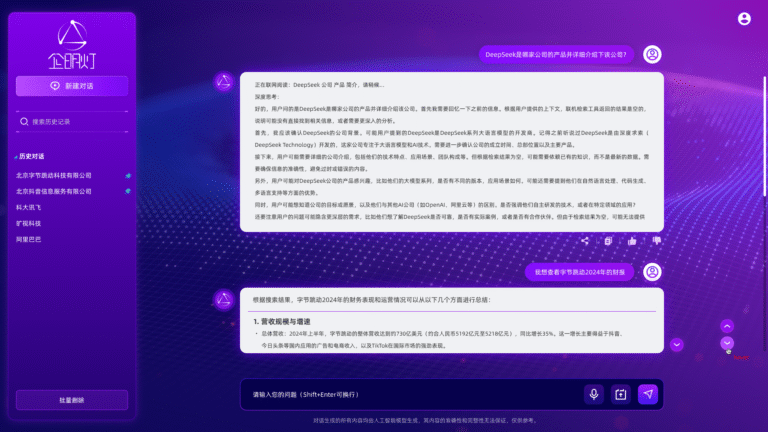

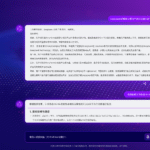

Intelligent Q&A & Report Generation Engine

Deep Integration of Four Professional Assessment Sub‑systems

Proprietary Pan‑Domain Data Source Network

Multi‑Terminal Collaborative Platform

Overall Architecture

Data & Computing Infrastructure Layer

Intelligent Middle Platform & Model Layer

Application & Interaction Layer

Key Advantages

AI‑Driven Intelligence, Beyond Data Accumulation

Controlled Data Sovereignty, Comprehensive & Live Dimensions

Four Systems Fused, Delivering Multidimensional Precision

Broad Scenario Coverage, Decision Efficiency Multiplied

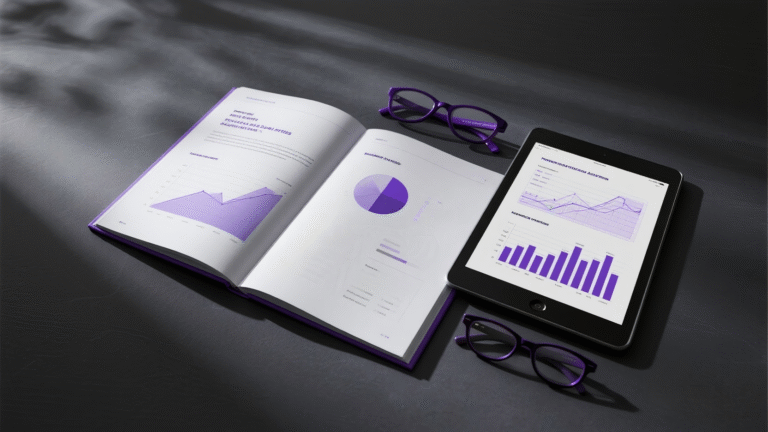

Quantified Benefits

-

Efficiency Boost:

Slash deep due diligence or credit assessment report generation from days to under 5 minutes, accelerating decision‑making by over 95%. -

Risk Detection Precision:

Our intelligent financial analysis model achieves a Top‑10 accuracy of 78% in identifying financial anomalies, effectively flagging potential fraud and operational risks. -

Data Coverage:

Dynamically processes over 50 billion corporate data records with 142 risk‑monitoring indicators, ensuring comprehensive and granular insights.

Application Scenarios

-

Financial Institution Credit Process Risk Control

A bank used Deming Deng’s Aladdin Credit Score for rapid pre‑loan screening of SMEs, while continuously monitoring related‑party dynamics via the Horizon module. When the system flagged an abnormal rise in the major shareholder’s equity pledge ratio, the risk department intervened promptly, averting a potential default. - Investment Institution Target Screening & Post‑Investment Management

A private equity firm searching for tech‑sector targets applied Deming Deng’s CAFE Scoring System to analyze innovation patents and industry competitiveness, quickly identifying “hidden champions.” Post‑investment, the Intelligent Financial Analysis System continuously tracked portfolio companies’ financial health, enabling early issue detection. - Enterprise Supply‑Chain Partnership Risk Assessment

A manufacturer evaluating a new supplier used Deming Deng to generate a comprehensive report covering credit score, litigation, association networks, and supply‑chain stability—uncovering undisclosed hidden guarantee risks and ultimately avoiding a high‑risk partnership. - Government Supervision & Market Surveillance

A local financial regulatory bureau leveraged the platform for batch risk scanning and monitoring of regional enterprises. Through multi‑dimensional risk indicators and association graphs, it efficiently identified and warned against clusters of potentially non‑compliant companies with complex cross‑shareholding and risk‑contagion structures, significantly enhancing regulatory effectiveness.